Forex Trading Hours Forex Market Hours Stock Market Hours IFCM India

Contents

Trading hours of onshore forex markets, especially the exchanges, are shorter in comparison to offshore exchanges which offer Rupee contracts (like DGCX, SGX, CME, ICE, etc.) (Table 3.2). These exchanges are located at major financial centres and offer a variety of products. Incidentally, although Rupee trades for hours on these exchanges, the majority of the volume (72-87 per cent) takes place during Indian trading hours (Table 3.3). The high liquidity also means that most currency pairs are traded with relatively thin spreads.

No additional orders for transactions can be placed during this time. Price matching order plays a vital role in determining the price at which the security is transacted during a normal session of Indian stock market timing. While the average investor should generally avoid the currency market, what occurs there has an impact on us all. The price we pay for exports and how much it costs to travel overseas will be influenced by real-time activity in the spot market.

The first section of three timings, starts between 9.00 am to 9.15 am. This section specifically deals with placing orders on the securities for sale and purchase. This is again, minute specific dealing which can be further divided into a set of three sessions. Cut-off time for commercial papers and certificate of deposits secondary market trading to be fixed at 5 p.m. It also recommended a change in its settlement time of primary open market operations from noon to 4 p.m.

Post-closing Session

On the other hand, central banks don’t share the same motivations as forex speculators. In this manner, a 24-hour currency exchange may be ideal for Americans that don’t live on the east coast. At present instead of GMT standard, which is rendered obsolete, it’s widely accepted to use UTC – Coordinated Universal Time. RoboForex server time differs from UTC by 2 hours (UTC +2), and in summer, with a switch to daylight-saving time, the difference equals to UTC +3. However, the market open or close times may be altered due to a lack of liquidity or pricing updates. Traders with open positions over weekends should be aware that these positions are susceptible to additional risk when significant events occur during the market closure.

- Pay 20% upfront margin of the transaction value to trade in cash market segment.

- At this time the trades are conducted in the European financial centers.

- When a trader places a buy or sells order in the market, forex brokers help the trader by providing margin.

- Speculators and expert traders are frequently the greatest candidates for forex trading.

- The stock exchanges specify the timings for the Muhurat trading session, which typically lasts for an hour on the occasion of Diwali.

The Sydney/Tokyo markets overlap (2 a.m. to 4 a.m.) is not as volatile as the U.S./London overlap, but it still offers opportunities. Some of the most active market times will occur when two or more Market Centers are open at the same time. The Forex Market Time Converter will clearly indicate when two or more markets are open by displaying multiple green “Open” indicators in the Status column.

How to become a Forex trader

Besides, the presence of customers, sensitive to volatile prices, would ensure that the banks stay active on exchanges also. During the weekdays, there’s always at least one forex trading session open although there are periods of downtime when the market is really quiet and trading volume is low or “thin”. You need to keep in mind that the trading schedule differs for different types of instruments. While most Forex pairs are open for trading non-stop from Monday to Friday, there are some exceptions. Such instruments as metals, oil, gas, US stocks, and indices are also traded from Monday to Friday, but their trading hours are different. Cryptocurrencies are available for trading throughout the whole week.

Apart from this favourable tax laws may also be an important determinant in choice of trading market. There are countries such as the US, UK, and Australia that observe Daylight Savings Time . This will also influence the open and closing times of the respective trading sessions.

On settlement side, there have been occasional requests to permit T+0 settlement for secondary market transactions which may facilitate funding unanticipated requirements. Offshore markets provide several advantages over onshore markets. The capital control regime requires that entities with Rupee exposure can access the onshore market for hedging. Even for hedgers, administratively, there is a natural incentive to operate in the offshore market so as to leverage their existing settlement as well as collateral arrangements through centralised treasuries. Product related restrictions in the onshore market e.g., swaps and structured options are not allowed to non-residents for hedging, may also limit the product choices for non-resident.

Best Time to Trade Forex

There is also lower supply and demand for currencies from emerging markets. During the autumn and winter months, the Tokyo session opens at 12am and closes at 9am UK time. It is one of the largest forex trading centres worldwide, with roughly a fifth of all forex transactions occurring during this session. During the Asian session, there’s likely to be more movement in currency pairs containing the yen, as well as Asia Pacific currency pairs, like AUS/USD. Four major foreign exchange markets in London, New York, Sydney, and Tokyo have different trading hours.

Professional traders pay thousands of dollars each month for access to major information providers. The Forex market is open 24 hours a day, and it is important to know which is the most https://1investing.in/ active trading period in which you can trade your chosen currency pairs profitably. A Forex trading hour’s clock gives you an accurate visual of which market is open at a given time.

The forex market is the largest and most active financial market in the world, known for its round-the-clock trading. Discover global FX market hours and when the kiev houses for sale best time to trade forex is. If you add all the volume on all the stock exchanges in the world, it would still not get close to the volume on the FOREX market.

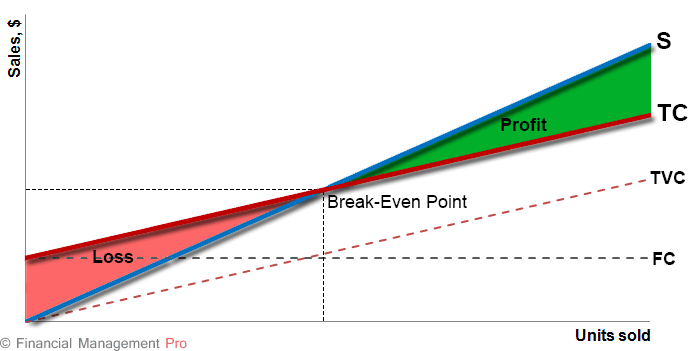

An overview of average hourly trading activity for 3 months is provided below (Chart 2.23). In the interbank market, spot trading is the dominant segment with a share of over 50 per cent in total turnover followed by swaps (Chart 2.2). In the client segment, forwards constitute about 58 per cent of total turnover, followed by spot at 42 per cent (Chart 2.3). To examine cross-country practices in the matter including the support infrastructure, and their influence, if any, on market development in terms of participation, liquidity, volume and similar factors.

Where can I trade forex in India?

The best Forex trading hours in South Africa, therefore, are when the market is the most active everywhere. This brings us to the overlap between the market hours of the three main trading centers. However, based on a study spanning the period from 1998 to 2018, the average intra-day volatility (Closet+0 – Opent+0) is 13 paise while the average overnight volatility (Opent+1 – Closet+0) is 6 paise. More significantly, there are substantially more days of high intra-day volatility than high overnight volatility. Roughly, 85 per cent of exchange rate volatility occurs during domestic market hours; perhaps even more because off-shore volatility is exaggerated due to relative illiquidity post Indian trading hours. The Reserve Bank regulates money markets, Government Securities (G-Sec) market, foreign exchange market and the markets for derivatives on interest rate, currency and credit derivatives.

Multilateral netting of funds and securities results in high degree of netting benefits for market participants in terms of liquidity requirement. Further, sufficient time is also required after completion of securities settlement so as to facilitate market participants to repay their intra-day credit lines availed from banks. Thus, availability of large value payment systems, such as RTGS, is essential for efficient functioning of the collateralised funding markets. By looking at the average pip movement of the major currency pairs during each forex trading session, we can see that the London session has the most movement. Trading low liquidity pairs naturally means higher risk, and is recommended for the more experienced trader who has done their research and has a risk management strategy in place. Find out more about the benefits and risks of trading forex in our guide to top tips for FX traders.

Close to rollover time, the spreads on different currency pairs can be much wider than usual. This can make it impractical and risky to trade close to rollover time, especially if you use a tight stop loss. Thus, it’s not a stretch to say that someone somewhere is will start currency trading at any given hour of the day.

Комментировать (0)