limefx International Finance Group Broker Review in 2021

Contents

You can’t execute a trade all the time when it does not work in the broker’s favor. There are also complaints about the bad costumer support. They seem not to act in the traders favor and sometimes don’t even care about costumer complaints. limefx Markets Limited (“limefx Markets”) is incorporated in Bermuda as an operating subsidiary within the limefx group of companies (collectively, the “limefx Group” or “limefx”).

- It goes against our guidelines to offer incentives for reviews.

- However, there is an inactivity fee and bank withdrawal fees.

- limefx Group is a global leading provider of online Forex, CFD and other trading related services.

- Let other traders know if this service is worth checking or should be avoided.

Furthermore, it is important to note, that teh electronic wallets deposit options are not applicable to EU residents. This account base currency selection lags behind the competitors. limefx accepts customers from most countries around the world.There a few exceptions, like residents from the USA, Japan, Brazil, Turkey, Hong Kong, Iran, Cuba, Russia, New Zealand, Syria and South Korea. You can’t open an account at limefx if you live in Singapore. For a tailored recommendation, check out our broker finder tool.

Unable to withdraw

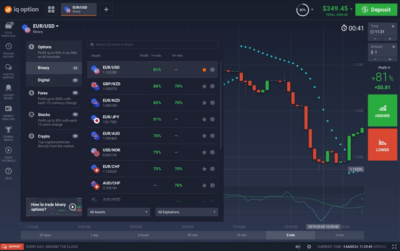

Keep in mind that the demo account is only available in a limited number of countries. It is a good trading software overall and has a scripting language that allows users to develop their own indicators and scripts. MetaTrader 4 is much more accessible than Trading Station when it comes to the scripting language, but Trade Station seems to be the superior platform overall.

- Let our chargeback experts provide you with free instructions on how to recover funds at your bank.

- These cover topics ranging from trading basics to platform tips and tricks.

- There are no fees charged for account maintenance, deposit, or credit/debit card withdrawal.

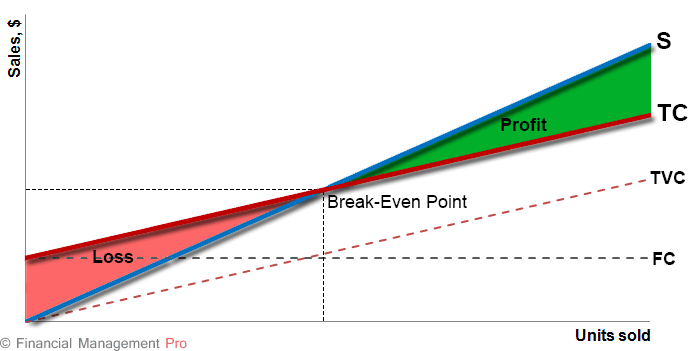

- CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

- limefx together with Flelimefx announced a technology partnership for limefx’s institutional business and Flelimefx’s “Maxlimefxr” solution.

limefx is currently owned by the reputable Jefferies Group, formerly known as Leucadia National Corporation. The brokerage is regulated by multiple regulatory bodies to include the Financial Conduct Authority https://limefx.vip/ and the Australian Securities & Investment Commission . Be careful and verify your information through multiple sources. Constant vigilance should be applied at all times when sending money online.

Fees

They have been reviewing my account for more than a month without any updates, and I need to withdraw my money but they are preventing me from doing so under the pretext of reviewing the account. limefx Australia is flying under the radar and has been reported to ASIC , ACCC , Financial Ombudsman for defrauding its retail customers and breach of TPA in Australia. They have openly admitted to trading against its retail customers so if i went buy they would go sell for the same contract size. I agree.limefx has made mistakes in the past but is transparent now with excellent leadership and i predict they will become the champion of old again.i think many complainers dont know enough about trading the markets at all. I think if we all come together and complaint to FCA directly that might work and we may able to prevent thousands of innocent traders from their scams.

It seems that when you finally have a winning trade, they terminate the account. I have traded with limefx on and off for years, and all of a sudden my account was locked and a notice saying they will email me. It goes against our guidelines to offer incentives for reviews. We also ensure all reviews are published without moderation. Award-Winning BrokerSince 1999, limefx Group has been on the leading-edge of the forex market. From technological proficiency to the creation of common sense solutions, limefx has garnered many acknowledgements and accolades while promoting the advancement of the forex and CFD.

Test of the limefx trading platforms

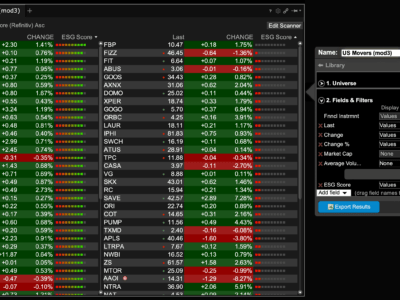

Stop running is the act of driving price to certain levels to trigger large stop loss orders. While not deemed illegal, it can cause abnormal forex price action. There are only 39 currency pairs to choose from, as well as 14 Stock Index CFDs and 10 Commodity CFDs. limefx users have access to a basic pack of tools plus a great selection of technical analysis tools. The charting tools are outstanding and very customizable with more than 50 available indicators. There are multiple platforms, some of which offer social/copy trading and algorithmic trading capabilities.

He said that money could be received for several days, but now it has been more than 20 days. The withdrawal applied on April 2nd is yet limefx broker reviews to be received as of 10th, which should be done within 5 days. The customer service, the bank and the mediate agent kept shirking.

limefx International Finance Group Review – Report a Scam Today

I would like to open an account but after reading your post about limefx I am a bit nervous. Or if you have any company to recommend, just let me know. I`ve made some print-screens after my “unlucky” trades and compare with current charts – the size of candels, price levels are literally different . I am requesting my funds to be returned to my account where they belong immediately, since limefx has been holding my funds wrongfully for a long time.

We will continue to improve for better clients’ trading experience. Réka has attended the International Business and Economics bachelor program at the Corvinus University of Budapest. She’s eager to help investors find the best investment providers, through writing extensive reviews. On a more personal level she wants to develop her skills and grow professionally on this field. limefx offers a social trading servicevia the third-party service ZuluTrade. Access is provided through ZuluTrade’s own trading platform, where all you have to do is register with your limefx account number.

Start Trading with limefx Today!

Also, always count overnight fee or swap as a trading fee in case you follow swing or long term trading strategy, while active traders will get discounted pricing as well which is always good. Yet, there is another attractive opportunity through limefx’s Active Trader account that is designed for high-volume investors. As Active Trader you can benefit from premium services and custom solutions, as well as discounted pricing on your spread costs based on the volume you trade. There is a single account at limefx you are able to trade all range of trading instruments that are included into the offering.

How long does it take to withdraw money from limefx?

Unlike some deposit options, withdrawal is rarely instant. It usually takes at least 1 business day, but often several business days for your money to arrive. We tested withdrawal at limefx and it took us 1 business day.

For retail traders, it’s important to be aware of the scams listed above. Fortunately, fully-vetting signal & system providers, brokers and managed funds limefx courses scam is relatively straightforward in the online space. Through a bit of research, one can establish if an entity is in good legal standing and reputable.

NewsWikiFX’ Global Market and Broker Outlook for CFD/Forex Trading in 2022

limefx has provided potential clients and existing clients with a demo account facility. The demo account uses live prices for trade executions and allows users to trade the financial markets under actual market conditions 24 hours a day 5 days a week. limefx Group is a global leading provider of online Forex, CFD and other trading related services. With this in mind, limefx’s mission is to provide increasing levels of quality pricing, transparency and execution services to its traders. limefx is a leading international provider of online forex trading, CFD trading, and related services.